5% Rule?

When you say set stops at 5%, do you usually use a 5% trailing stop, or is that 5% from your original buy point? If it's 5% from the original buy, at what point would you raise you stop to break-even?

Thanks,

Caleb

Caleb

That is a great question. I use the 5% stop-loss when first making a purchase. If I buy a stock and it goes down 5% then I did something wrong. I bought at the wrong price or the market is working against me. It doesn't really matter. I just know the trade is working against me, and I must exit the trade. I will sell and figure it out later with post-analysis. We cannot afford to take large losses.

If the stock advances I use the low of the day as a stop as I do not want to own a stock making new lows. It is prudent to take a profit and move on to the next trade.

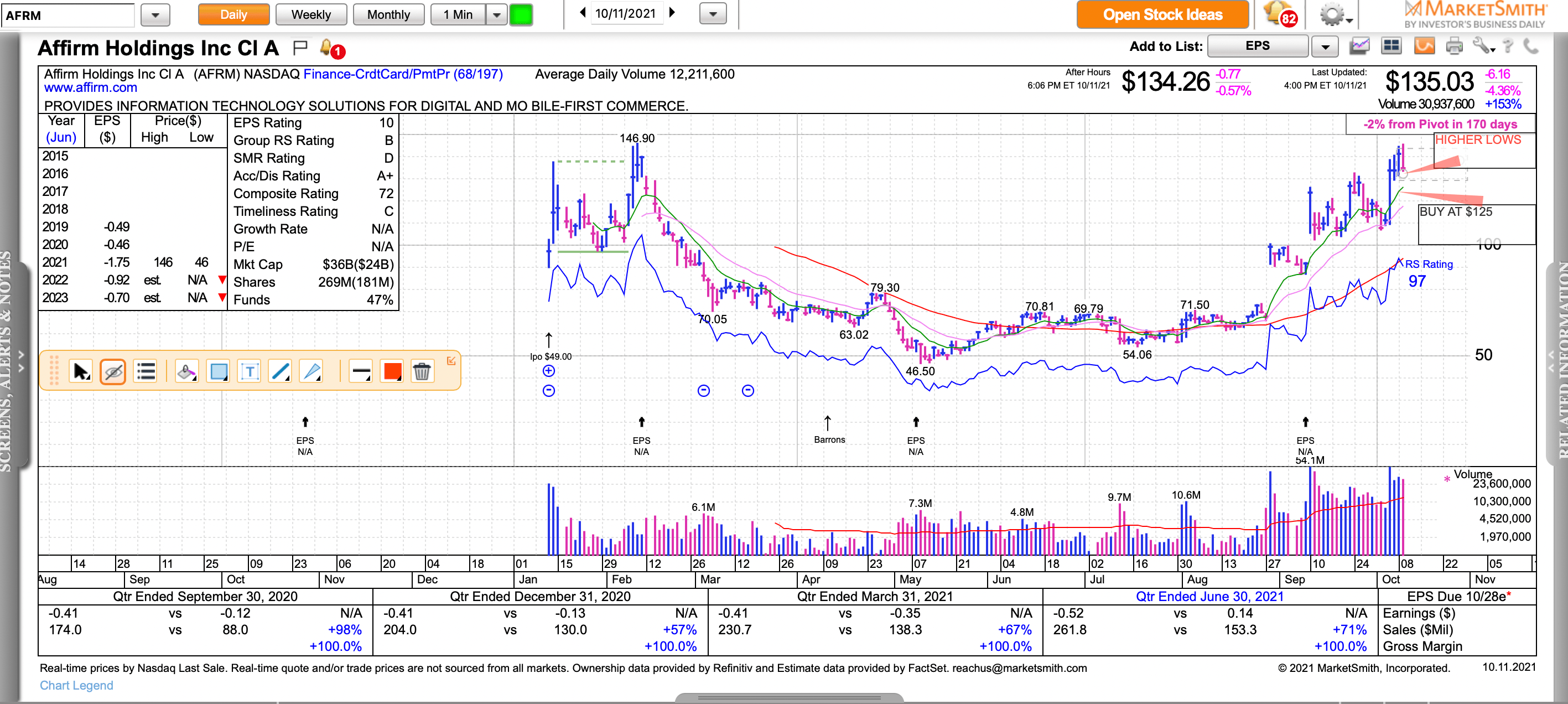

For example, let's say we bought AFRM last Wednesday at $125.00 as it was up 20% on the day with strong volume. The next day it follows through with a low of $129.18. That low on Thursday is my stop-loss ($129.18) as we do not want to own a stock making a new low. On Friday the stock advances again with a low of $131.60. My stop-loss moves up to $131.60 as we do not wan to hold a stock making a new low. Today the stock gave back some of its gains. But, we still hold it because it did not make a new low. If the stock takes out $131.60 tomorrow we get stopped out with a small gain.

I hope this answers your question.

Regards,

Marty